Page 17 - Issue-15

P. 17

ELITE ISSUE 15 , JANUARY 2020 P AGE 17

SHORT SELLING IN

STOCK EXCHANGE

Mohamed Fawzy, Third Level , Economics

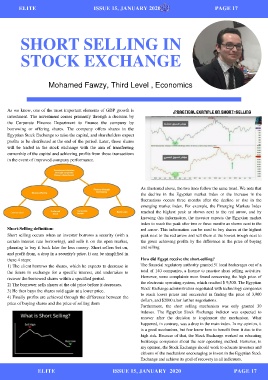

:Practical example on short-selling

As we know, one of the most important elements of G DP growth is

investment. The investment comes primarily through a decision by

the Corporate Finance Department to finance the com pany by

borrowing or offering shares. The company offers sh ares in the

Egyptian Stock Exchange to raise the capital, and s hareholders expect

profits to be distributed at the end of the period. Later, those shares

will be traded in the stock exchange with the aim o f transferring

ownership of the capital and achieving profits from those transactions

in the event of improved company performance.

As illustrated above, the two lines follow the same trend. We note that

the decline in the Egyptian market index or the increase in the

fluctuations occurs three months after the decline or rise in the

emerging market index. For example, the Emerging Markets Index

reached the highest peak as shown next to the red arrow, and by

knowing this information, the investor expects the Egyptian market

index to reach the peak after two or three months as shown next to the

Short-Selling definition:

red arrow. This information can be used to buy shares at the highest

Short selling occurs when an investor borrows a sec urity (with a

peak next to the red arrow and sell them at the lowest trough next to

certain interest rate borrowing), and sells it on t he open market, the green achieving profits by the difference in the price of buying

and selling

planning to buy it back later for less money. Short sellers bet on,

and profit from, a drop in a security's price. It c an be simplified in

How did Egypt receive the short-selling?

these 4 steps:

The financial regulatory authority granted 51 local brokerages out of a

1) The client borrows the shares, which he expects to decrease in

total of 140 companies, a license to practice short selling activities.

the future in exchange for a specific interest, and undertakes to

However, some complaints were found concerning the high price of

recover the borrowed shares within a specified peri od.

the electronic operating system, which reached $ 9,500. The Egyptian

2) The borrower sells shares at the old price befor e it decreases.

Stock Exchange administration negotiated with technology companies

3) He then buys the shares sold again at a lower pr ice.

to reach lower prices and succeeded in finding the price of 3,900

4) Finally profits are achieved through the differe nce between the

dollars, and $2000 after further negotiations.

price of buying shares and the price of selling the m

Furthermore, the short selling mechanism was only granted 30

indexes. The Egyptian Stock Exchange indictor was expected to

recover after the decision to implement the mechanism. What

happened, in contrary, was a drop in the main index. In my opinio n, it

is a good mechanism, but few know how to benefit from it due to th e

high risk. Because of that, the Stock Exchange worked on educating

brokerage companies about the new operating method. However, in

my opinion, the Stock Exchange should work to educate investors an d

citizens of the mechanism encouraging to invest in the Egyptian Sto ck

Exchange and achieve its goal of recovery in all indicators.

ELITE ISSUE 15 , JANUARY 2020 P AGE 17